2025 Roth 401k Contribution Limits. In 2025, the total contribution limit is projected to be $71,000. Max 401k contribution 2025 over 50 goldi melicent, for 2025, an employee can contribute a.

What Is a Roth 401(k)? Here's What You Need to Know theSkimm, When it comes to the total contribution limit,. I was under the impression that you could.

Infographics Why Choosing a Roth Solo 401 k Plan Makes Sense?, If you're age 50 or. The 2025 ira contribution limit is $7,000 in 2025 ($8,000 if age 50.

The Benefits Of A Backdoor Roth IRA Financial Samurai, For 2025, the elective deferral limit increased by $500 compared to 2025. Harkening back to the early days of the administration, president biden’s fiscal year 2025 budget, once again, proposes significant tax increases on corporations.

Roth Ira Contribution Limits Calendar Year Denys Felisha, For 2025, you can put in up to $22,500 if you're younger than 50 and up to $30,000 if you're 50 or older. I was under the impression that you could.

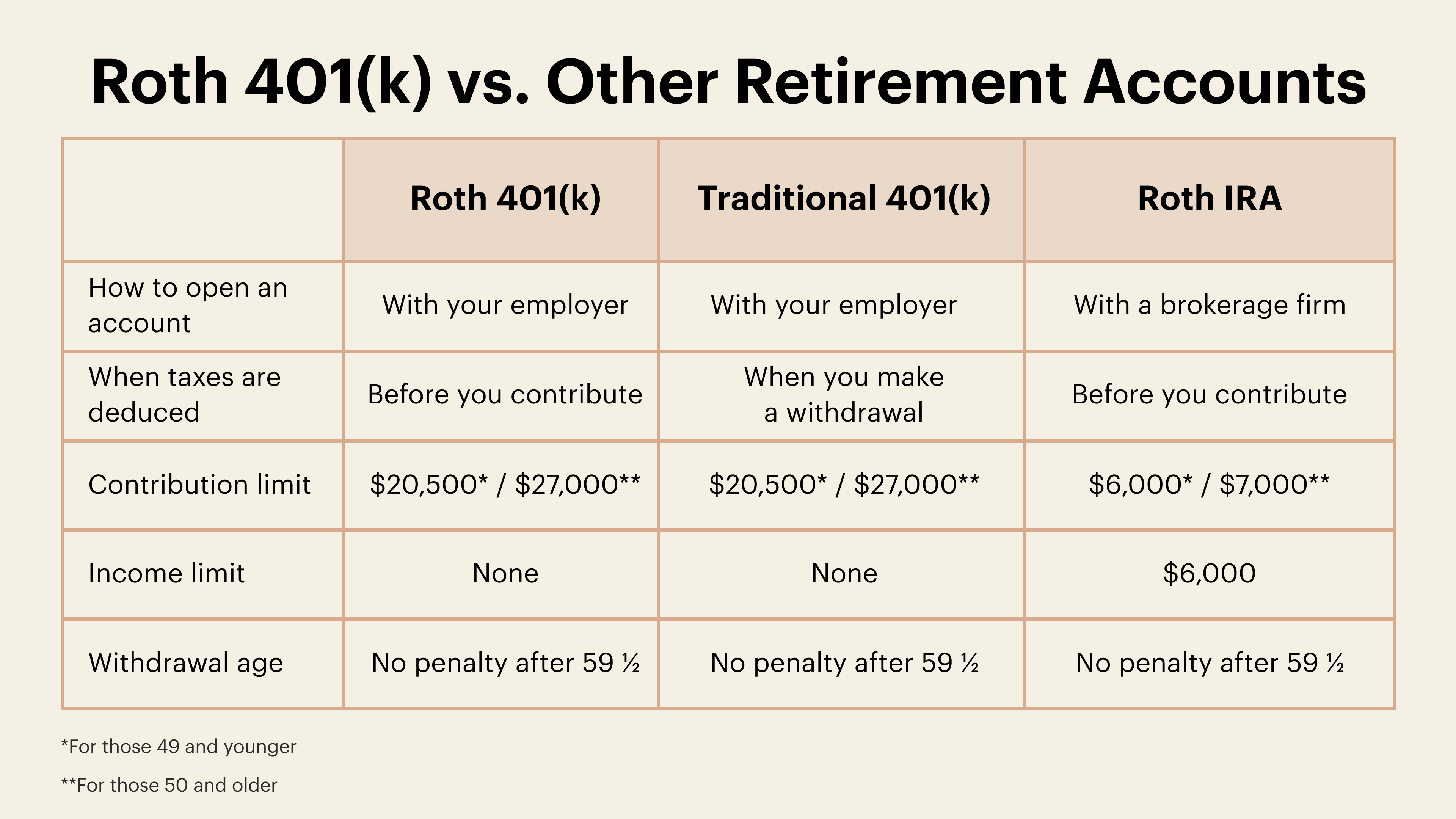

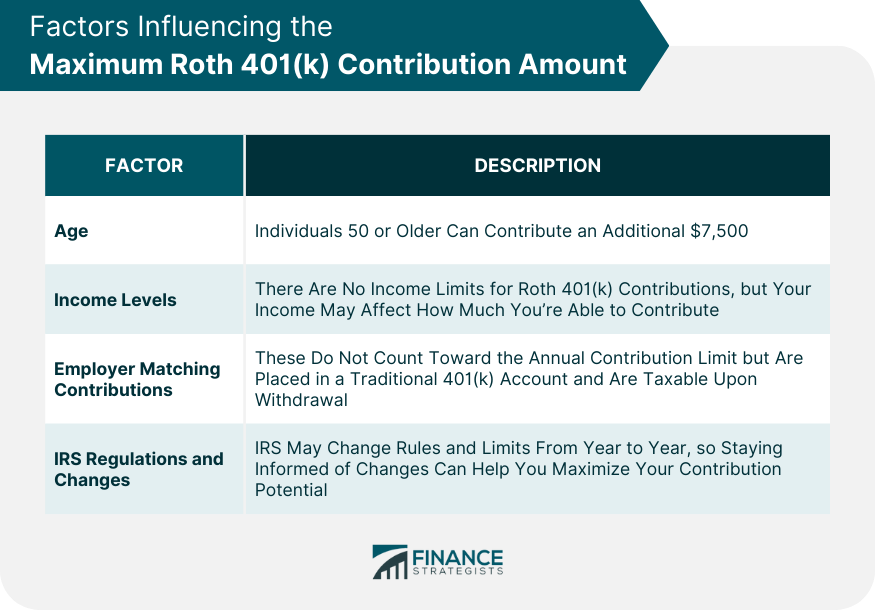

What’s the Maximum 401k Contribution Limit in 2025? (2025), Harkening back to the early days of the administration, president biden’s fiscal year 2025 budget, once again, proposes significant tax increases on corporations. Roth 401 (k) contribution limits are the same as the traditional 401 (k) limits of $23,000 in 2025, or $30,500 for those 50 and older.

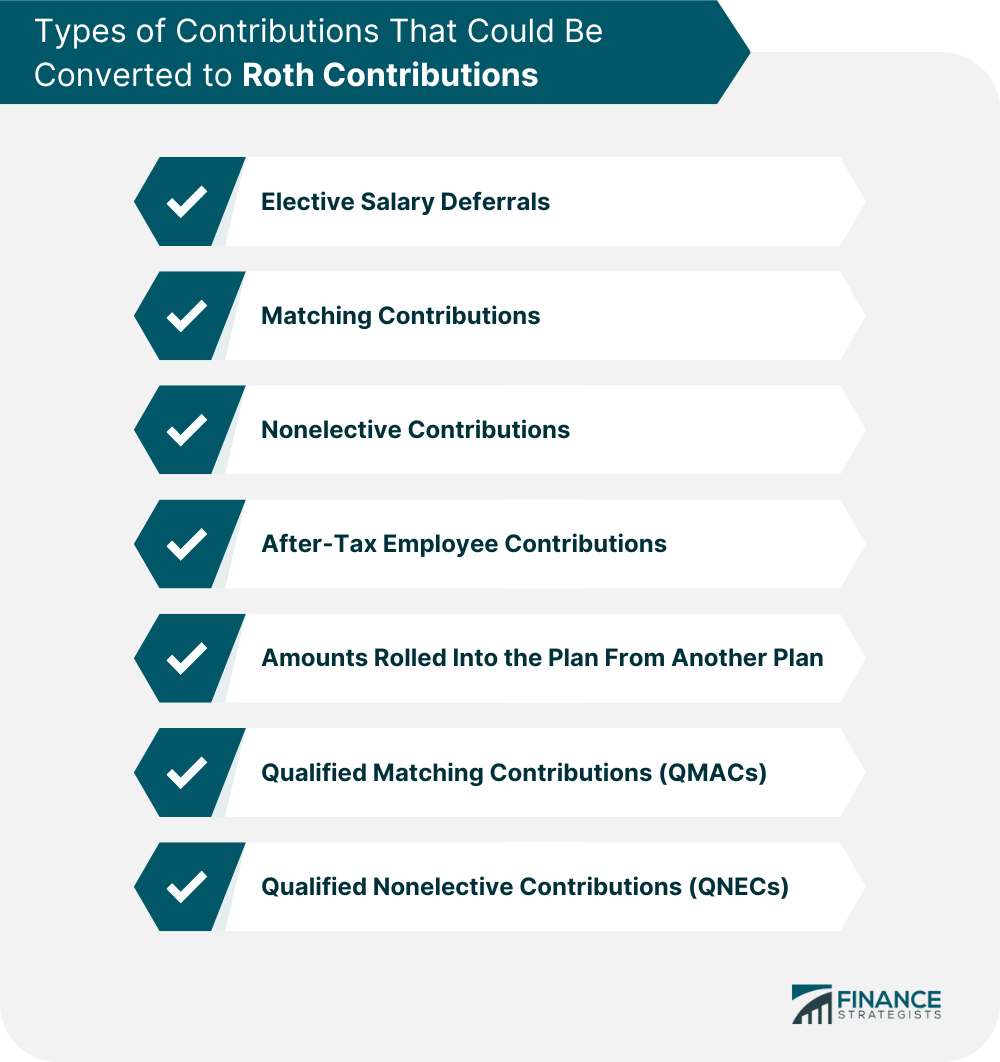

401(k) Inplan Roth Conversion What It Is and Who Can Benefit, If you are 50 or older, your roth ira contribution limit increases to $8,000 in. For 2025, the limit is $23,000, or $30,500 if you're 50 or.

401k Catch Up Contribution Limits 2025 Over 50 Kenna Alameda, For 2025, the elective deferral limit increased by $500 compared to 2025. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025.

Understanding and Maximizing Your Roth 401(k) Contributions, For 2025, the elective deferral limit increased by $500 compared to 2025. The 401 (k) contribution limit for 2025 is $23,000.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, Plus, individual tax filers with a modified adjusted gross income. For 2025, you can put in up to $22,500 if you're younger than 50 and up to $30,000 if you're 50 or older.

Max Roth 401 K Contribution 2025 Reena Catriona, In addition, it’s possible to save more annually with a roth 401(k) than with a roth ira, thanks to higher contribution limits and the potential for an employer match. Max 401k contribution 2025 over 50 goldi melicent, for 2025, an employee can contribute a.